Hopefully, Gov. Ned Lamont will sign Connecticut’s ambitious housing bill, HB 5002, because it would help overcome a legacy of redlining and increase housing equity and affordability for all Connecticut residents.

Our nation and the state of Connecticut confront a housing shortage and high costs due to decades of underinvestment and exclusive zoning which has restricted housing supply and increased costs for all households but particularly for modest income ones that often pay an unsustainable 30 percent and more of their monthly income for housing.

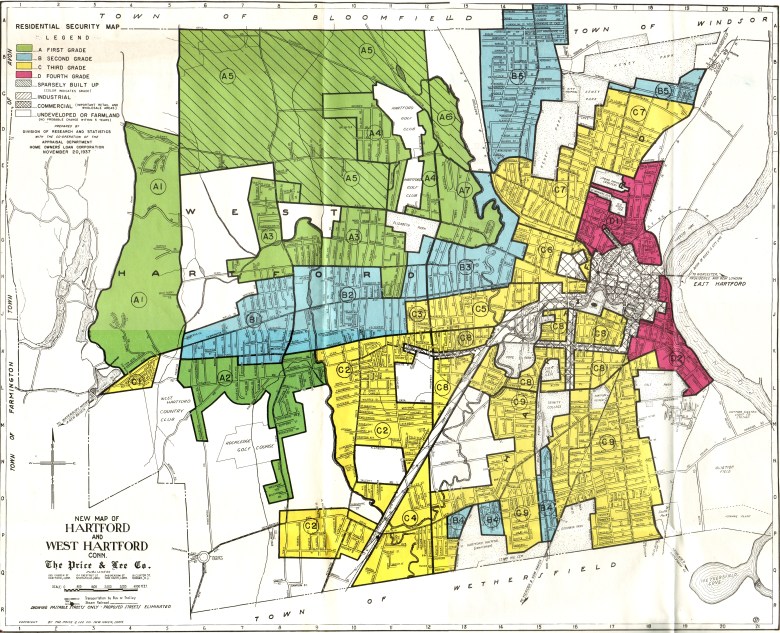

We got to this point because of an ugly history of racism and segregation that plagued most communities in our country. In the 1930s, the federal government commissioned the creation of maps, using the insights of the housing and lending industries, that classified neighborhoods by risk and the chances that borrowers would default on their loans. These maps all too often classified African-American neighborhoods and those populated by Jews and other Eastern European immigrants as too risky for lending. These were color coded red – hence the name redlining. Over the ensuing decades, these neighborhoods received few loans, contributing to decay and abandonment of the housing stock.

Andrew Kahrl, in his book Free the Beaches, documents how redlining and other forms of discrimination such as covenants against selling homes to African Americans contributed to literally cornering African Americans to certain neighborhoods in Hartford and other cities in Connecticut. For example, the North End in Hartford experienced a rise of slumlords and unhealthy housing infested by rats and incubation centers of tuberculosis and other diseases.

Today, the legacy of redlining remains substandard housing disproportionately impacting communities of color and dramatic racial disparities in wealth significantly due to disparities in homeownership among whites and people of color.

Connecticut HB 5002 represents an opportunity to not only atone for this discrimination but also to provide everyone with a chance for a better quality of life and wealth building through higher rates of homeownership. This benefits all of us since poorly housed populations would then become healthier and increase their economic activity, resulting in a more prosperous economy for everyone.

HB 5002 would require towns to create specified numbers of additional housing, including for low- and moderate-income households, based on calculations of need and housing scarcity. Certain zoning requirements would be eased if jurisdictions wanted to build higher density housing. Minimum parking requirements would be eased. Allowance for more housing types including duplexes and small multifamily housing developments would combat decades of exclusionary zoning that only allowed single family housing and restricted the housing supply.

If the governor signs the bill, these provisions will help increase the housing supply and bolster integration. What stakeholders also need to consider is how to apply the incentives under the Community Reinvestment Act (CRA) in innovative ways. Congress passed CRA and President Jimmy Carter signed CRA in 1977 to combat redlining by requiring banks to serve all communities, including low- and moderate-income ones. Banks receive ratings or grades based on how many loans, investments, and services they offer in modest income communities.

In my recently published book, I describe how CRA provides incentives for banks to partner with cities and counties to embark on affordable housing and community development. For example, Bank of America and PNC recently committed to investing $100 million in formerly redlined neighborhoods in Baltimore.

Connecticut towns could approach banks and figure out how to combine public subsidies with bank loans and investments to build new affordable housing developments and rehabilitate existing housing stock. State and local low down payment programs for homeownership could be better coordinated with bank mortgage lending to expand upon homeownership opportunities for those that have been underserved. Jurisdictions could develop housing plans that not only specify the numbers of additional homeowner and rental units but also how these would be funded.

It is time for bold plans. Segregation and redlining have contributed to polarization, distrust, and economic stagnation. Embracing a new future of integration and mutual aid will make for a more prosperous and harmonious state. Governor Lamont should make this his message in a grand bill signing ceremony.

Josh Silver of Morris is a Senior Fellow at the National Community Reinvestment Coalition and author of Ending Redlining through a Community-Centered Reform of the Community Reinvestment Act.